Free Accounting Software Expo

Bringing the cloud to ground level.

Now that NBN is a reality in Dalby, there is increasing interest in cloud accounting programs. Once inhibited by internet quality, the region is now better placed to take full advantage of what cloud accounting has to offer. After talking with a range accounting software providers – one thing is for sure, desktop software is out and cloud software is in.

For some this might seem a scary, while others can’t wait to get on board. Even if you aren’t ready to make the move yet, it’s important to start educating yourself on ‘cloud’ and the benefits it can offer your business. Positives include real time financial information from direct bank feeds, on-the-go invoicing, and the ability to view your accounting files from anywhere in the world. We’ve also found that some cloud software has some great in-built payroll systems which were historically a downfall of some of the desktop versions.

Despite what you might think, you don’t have to be a technical guru to use cloud products. We had some clients who were quite traditional in their bookkeeping, who were even still using paper reporting, switch to a cloud based-product and found it easy to use and fantastic for their lifestyle.

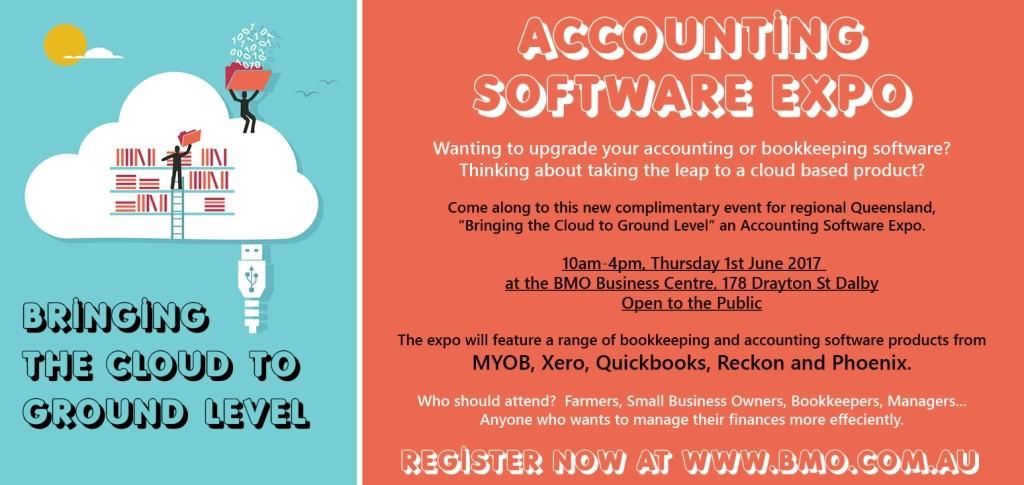

To help you get all the information you need in one location, BMO is hosting a free cloud accounting software expo on Thursday, 1 st June. All the big players will be there including Xero, MYOB, Intuit Quickbooks Online, Phoenix by AgData and Reckon. Find out more here>>

Anyone can come along to learn more about what the different packages offer, how they work, and find something that’s right for you.

The post Free Accounting Software Expo appeared first on BMO Accountants.

Contact Us

BMO Dalby

By Mail:

PO Box 180

Dalby Qld 4405

In Person: 178 Drayton Street (access via Hogan Street)

Dalby Qld 4405

BMO Charleville

By Mail:

PO Box 198

Charleville Qld 4470

In Person: 58 Alfred Street

Charleville Old 4470

BMO Roma

By Mail: PO Box 300 Roma Qld 4455

In Person: 137 McDowall Street Roma Qld 4455

Office Hours:

Monday – Thursday 8am – 5pm and Friday 8am – 3pm

PH: 07 4662 3722

FAX: 07 4662 5975

Useful Links

Stay in Touch

Footer Contact Form

We will get back to you as soon as possible

Please try again later

Contact Us

BMO Dalby

By Mail: PO Box 180 Dalby Qld 4405

In Person: 178 Drayton Street (access via Hogan Street) Dalby

BMO Charleville

By Mail:

PO Box 198

Charleville Qld 4470

In Person: 58 Alfred Street

Charleville Old 4470

BMO Roma

By Mail: PO Box 300 Roma Qld 4455

In Person: 137 McDowall Street Roma Qld 4455

Office Hours: Monday – Thursday 8am – 5pm and Friday 8am – 3pm

PH:

07 4662 3722

FAX: 07 4662 5975

Footer Contact Form

We will get back to you as soon as possible

Please try again later

All Rights Reserved | BMO Dalby | Website design & development by Hey Marketing